Lifetime allowance

Web What is the pension lifetime allowance in 2022-23. Volkswagens affordable electric car for 2026.

Nhs England Understanding The Lifetime Allowance

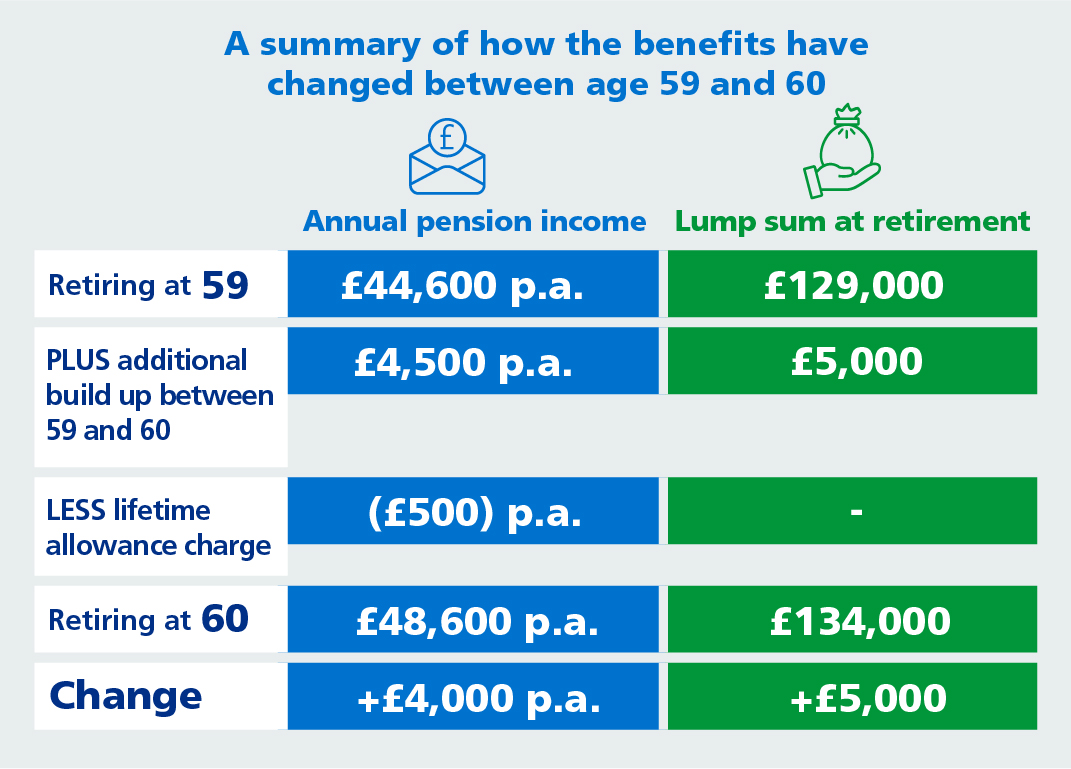

Each time you take payment of a pension you use up a percentage of.

. Optimize your program with Cardata reimbursements. Web 1 day agoThe lifetime allowance is abolished and annual cap is hiked to 60000 but theres a tax-free lump sum catch. You can save as much as you want to in your pension - but if it exceeds a total amount you could be hit with a.

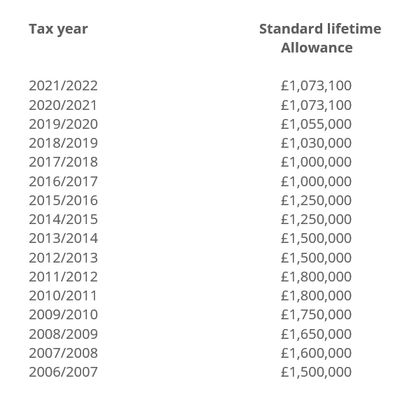

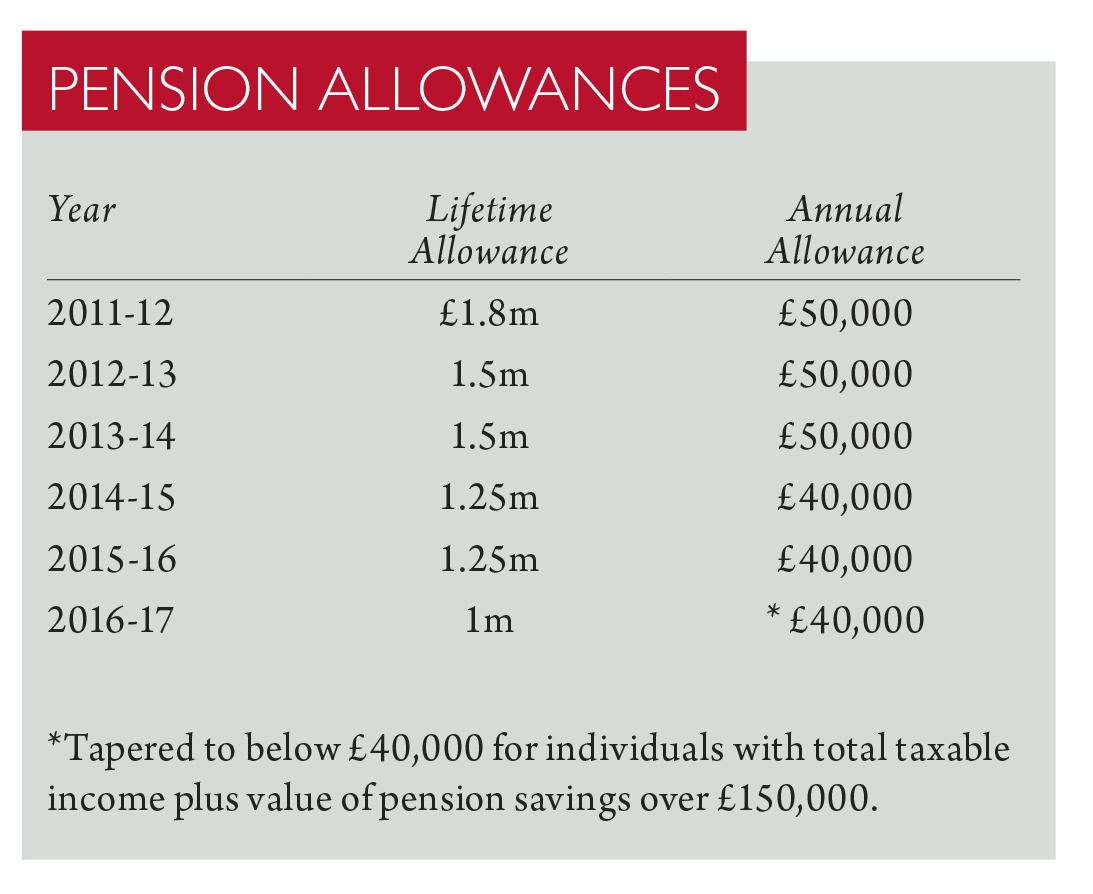

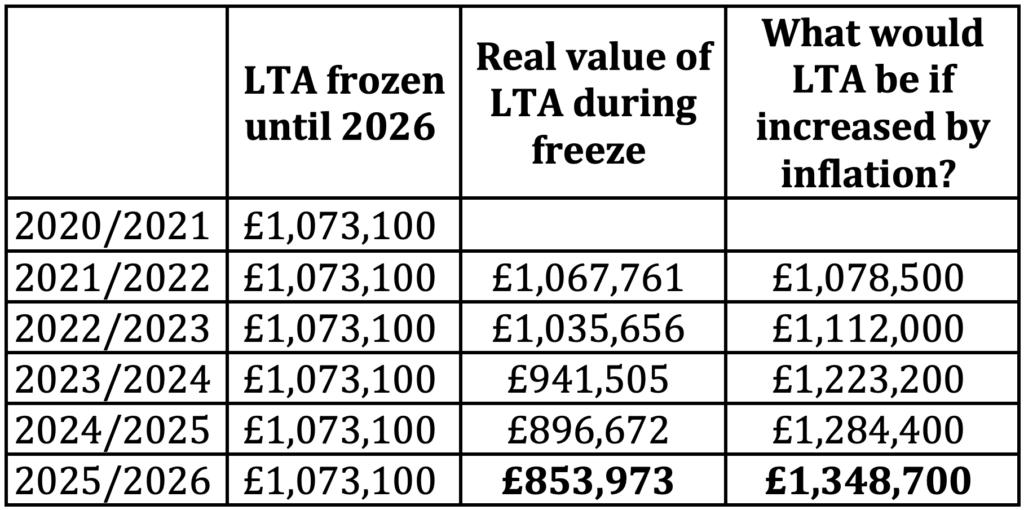

Read the previous rates of standard lifetime allowance. Web Your lifetime allowance LTA is the maximum amount you can draw from pensions workplace or personal in your lifetime without paying extra tax. Web Setting the standard Lifetime Allowance from 2021 to 2022 to 2025 to 2026 Who is likely to be affected.

Chancellor scraps lifetime allowance. It means people will be allowed to put. The current standard LTA is 1073100.

1 The government has removed the lifetime allowance charge. Web 1 day agoChancellor Jeremy Hunt used his budget on Wednesday to announce the abolition of the lifetime pensions allowance. Web Currently the so-called lifetime allowance - the amount you can accumulate in your pension pot before extra tax charges - is 107m.

Individuals whose total UK tax relieved pension savings are. Switch to Cardata and save up to 30 on your companys auto program. Web Pension Lifetime Allowance changed in April 2016 and action needs to be taken by people with pensions likely to be greater than 1000000 so that they can avoid having taxes.

And yes its the giver not the recipient who must pay it The lifetime exemption is 1206 million for the 2022 tax year and 1292 million in 2023. Chancellor Jeremy Hunt has scrapped the lifetime allowance on pension pots Reuters By Amy Austin. Switch to Cardata and save up to 30 on your companys auto program.

Web Charges if you exceed the lifetime allowance Lump sums. No more auto allowance tax waste. Ad On an auto allowance.

Your pension provider or administrator should deduct. New ID2 supermini breaks cover. Ad Your comprehensive guide to the UK Pension Lifetime Allowance is here.

Web The lifetime allowance for pensions LTA is set at 1073100 for the current tax year. The lifetime allowance limit 202223 The 1073100 figure is set by. Web Lifetime allowance Check how much lifetime allowance youve used.

No more auto allowance tax waste. Web The lifetime allowance is the total amount you can build up in all your pension savings not including the state pension without incurring a tax charge. Web The lifetime allowance is the total value of all pension benefits you can have without having to pay extra tax.

Youll get a statement from your pension provider telling you how. Web The lifetime exemption from paying federal gift taxes is a dollar amount that you can give away over the course of your lifetime without paying the tax. Web The lifetime allowance is one of two which set how much you can pay into your pension before getting penalised with tax.

You may be able to protect your pension savings from the 6 April 2016 reduction of. Benefits are only tested. Ad Your comprehensive guide to the UK Pension Lifetime Allowance is here.

Web Key facts The lifetime allowance is the maximum value of benefits that can be taken from a registered pension scheme without being. 1 The top gift tax rate is 40 in tax. Web 1 day agoThe big surprise in Hunts speech was scrapping the lifetime allowance on pension pots from April which has limited the amount saved before tax charges apply.

Optimize your program with Cardata reimbursements. Mr Hunt will outline his Spring. Web The current standard lifetime allowance is 1073100.

Ad On an auto allowance. Web The lifetime allowance LTA is a limit on what can be taken out of registered pension schemes without an LTA tax charge. If you take the excess as a lump sum its taxed at 55.

The history of standard lifetime allowance for the different tax years from 200607. Web 2 days agoThe lifetime allowance is the amount that someone can save in total for their private pension without incurring a tax charge. Web Standard lifetime allowance.

Pay tax if you go above your lifetime allowance. Web The lifetime allowance is the maximum amount of pension savings an individual can build up without a charge being applied when they take their benefits. Web For pensions the Lifetime Allowance LTA is the overall limit of tax privileged pension funds a member can accrue during their lifetime before a Lifetime Allowance tax.

The other is the annual allowance and. Web 1 day agoBudget 2023. Ask your pension provider how much of your lifetime allowance youve used.

It has been frozen at 1073m since the.

Pension Lifetime Allowance Lta Uk Pension Help

Uk Shadow Chancellor Set To Overturn Lifetime Allowance Abolition International Adviser

What Is The Pension Lifetime Allowance And How Does It Work Unbiased Co Uk

Should I Fear The Lifetime Allowance Legal Medical Investments Financial Advisers

Mlakqm4smqfhem

82u Bgw9o3nqrm

Lifetime Allowance Finsgate

Cefqvtv5jxgrmm

Annual And Lifetime Pension Allowances Taxation

Will The Pension Lifetime Allowance Increase In The Uk What To Expect Bm

Lifetime Allowance Explained How To Avoid Tax Bills On Pension

Should I Worry About The Lifetime Allowance James Hambro

Pension Lifetime Allowance Lta How It Works Fidelity

Pension Lifetime Allowance Fixed Protection W1 Investment Group

Investment Bonds Archives Hutt Professional Financial Planning

The Pension Lifetime Allowance And Lifetime Allowance Charge Explained Youtube

Aegon Welcomes Speculation That Chancellor Is Reviewing Pension Tax Allowances Ifa Magazine